- Investing Journal

- Posts

- 📈 Missed the U.S. AI Rally? Here’s Your Second Shot

📈 Missed the U.S. AI Rally? Here’s Your Second Shot

AI bets in China, a possible shutdown, soaring stock exposure, and one underrated career move that could change your financial future. Let’s break it down.

Good Morning & Happy Monday.

Markets are up this morning, with futures climbing as investors watch for shutdown news and Friday’s key jobs report. Chinese AI stocks are catching fire, Wall Street exposure is hitting record highs, and we take a closer look at why selling skills might be the most underrated edge in finance.

Grab your Cappucino and let’s get into it. ☕️ 👇️

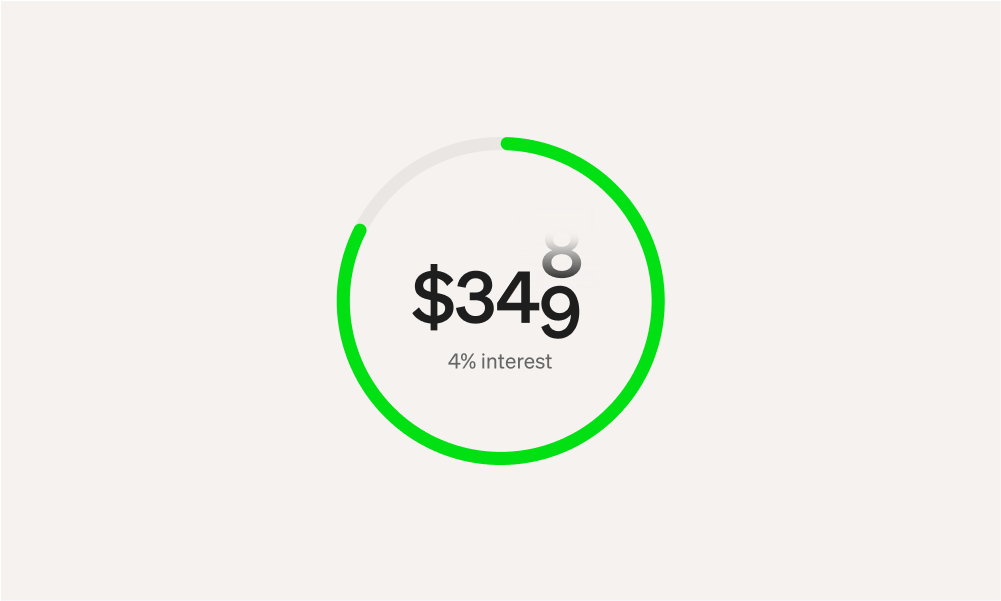

With Cash App, it can.

Round up your spare change from your coffee runs, save part of every paycheck with direct deposit, and make your savings work for you with up to 4% interest.* Plus, there are no monthly or hidden fees.

Save and transfer money whenever you want, and know your money is safe with 24/7 fraud monitoring and proactive security features.

Note: “Cash App is a financial services platform, not a bank. Banking services provided by Cash App's bank partner(s). Prepaid debit cards issued by Sutton Bank,

Market News

📈 Futures climb with government shutdown in focus

Stock futures ticked higher Monday morning, even as a potential U.S. government shutdown looms by midweek. The Dow and S&P 500 both edged up 0.4%, while the Nasdaq 100 rose 0.5%. Why does this matter? Because a shutdown could delay critical economic data, including Friday’s all-important jobs report that Wall Street and the Fed are watching closely. A Monday meeting between Trump and congressional leaders may be the last shot at avoiding the shutdown.

🤖 The Hunt for AI Gains Is Lifting Chinese Stocks

Foreign investors are jumping into Chinese stocks, betting big on the country's growing AI edge and cheaper valuations. With AI hype still red-hot and U.S. tech names already pricey, many see China as a second wave opportunity. Chinese indexes are outperforming, the CSI 300 is up 20% YTD, beating the S&P 500's 13%. Invesco’s China tech ETFs? Up over 50%. “If you missed the AI boom in the U.S., China might be your second shot,” says Invesco’s Rene Reyna.

📊 Americans have more money in stocks than ever before

Americans now have a record 45% of their financial assets in stocks, thanks to booming markets and growing retirement account participation. But that record-high exposure comes with risk, if stocks tumble, wallets across the country will feel it fast. The concern? This level of stock ownership just passed dot-com bubble highs. And with the labor market softening and inflation still sticky, a downturn could hit harder than before. The upside? More people are benefiting when markets rise, but the stakes are now higher for everyone.

🇺🇸 Trump's stealth corporate 'tax' hike could be what the US needs

Call it a stealth tax or a strategic pivot, but the U.S. may have found a clever way to boost revenue without raising traditional taxes. With tariffs generating $162B and rising, plus equity stakes in companies like Intel and Nvidia bringing in even more, this approach could quietly chip away at the deficit. Yes, it bends economic orthodoxy, but in a world of massive corporate profits and fiscal gridlock, it might just be the creative fix that the US needs.

Invest & Strategies

👀 Five Reasons the AI Boom Isn't in 'Dot-Com' Bubble Territory (Yet)

Is the AI boom a bubble? Maybe. But if it is, it's a very different kind. Since ChatGPT’s debut, the S&P 500 is up ~70% and tech giants have added over $15 trillion in market cap, yet current valuations still don’t rival the dot-com insanity. Even Zuckerberg admits we might be in a bubble, but compared to the wild speculation of the late ’90s, this feels more like a rational build-out than a mania, at least for now.

❗️The Most Important Skill in Finance

If you're an introvert trying to build a career, here's the hard truth: you still need to learn how to sell. Not shady, pushy sales, but the ability to communicate, persuade, and pitch your ideas with confidence. Everyone is in sales, whether they realize it or not. From landing a job to pitching investment ideas, or even building relationships, your success hinges on how well you can tell your story. And here's the good news: if you believe in what you’re doing, it doesn’t feel like selling, it feels like sharing something that matters.

🤔 11 Things I learned as a Financial Planner

Financial planner Elliott Appel has spent years working with real people, widows, caregivers, families, and he's picked up some surprising lessons along the way. In his latest post, he shares 11 takeaways about money, health, and habits, like why most people never feel financially secure, and how community matters more in retirement than your portfolio does. It’s a down-to-earth read that might shift how you think about planning your future.

💰️ Could Trump Accounts be the Best College Savings Option?

Under Trump’s new “One Big Beautiful Bill,” families with young kids could get a $1,000 head start in the stock market. The plan would create “Trump Accounts”, tax-preferred investment accounts funded by the Treasury for every U.S. child born from 2025 to 2028. It’s being pitched as a long-term wealth builder, this article compares it to other programs.

Best Of Twitter

This gold run is absolutely insane:

Gold just made its 38th all time high of 2025 with gold futures now up +43% year-to-date.

This puts on gold on track for its best year since 1979 as the Fed cuts rates into 3%+ inflation.

Gold knows what's coming next.

— The Kobeissi Letter (@KobeissiLetter)

2:50 AM • Sep 29, 2025

Our Recommendations:

💻️ MEXC - Where we find and trade Crypto with low fees.

📈 TradingView - Software we use to chart stocks.

🔐 Trezor - Our favorite hardware wallet to keep our Crypto secure.

🦑 Kraken - Where we buy crypto with cash / withdraw profit to our bank.

👀