- Investing Journal

- Posts

- Google Soars, Gold Breaks $3,500, Bonds Tank

Google Soars, Gold Breaks $3,500, Bonds Tank

A huge win for Google, record highs for gold, global bonds under pressure, plus Italy’s rally, Lucid’s stumble, and Nvidia’s next big bet. Don’t miss today’s insights.

Good Morning & Happy Wednesday!

Today’s we’ll look at Google’s antitrust win and stock surge, gold breaking $3,500, and a global bond selloff shaking markets.

We also look at Italy’s undervalued rally, Lucid’s reverse split stumble, surprising market charts, September’s stock curse, diversification struggles, and Nvidia’s next growth catalyst.

Grab your Americano and let’s get into it. ☕️ 👇️

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Markets

🔎 Google soars after judge says it doesn't have to sell Chrome

A federal judge ruled that Google won’t be forced to sell Chrome in the DOJ antitrust case, though it must curb exclusive contracts and share certain data; following the decision, Google’s stock jumped more than 8% in after-hours trading while Apple’s shares rose over 3% as it can continue receiving $20 billion annually from Google to keep Search as the default on Safari.

🥇 Gold Hits New $3500 Record Thanks to Silver, Debt, Inflation, the Fed

Gold prices hit a record above $3,500 per ounce, with bullion also reaching new highs of ¥16,693 per gram in yen and £2,613 per ounce in pounds, while stocks and long-term bonds slid. The surge reflects rising investor concerns over inflation and fiscal risks, as gold has gained 75% in five years while U.S. Treasuries halved in value. Analysts say momentum trading and silver’s rally added fuel, even as rate-cut odds remain unchanged in futures markets.

📉 Global Bond Selloff Deepens

Global bonds are sliding as inflation fears, heavy debt issuance, and fiscal concerns drive long-term yields higher. The U.S. 30-year Treasury yield neared 5%, the UK’s 30-year hit 5.75% (highest since 1998), and Japan’s 20-year touched its highest this century. A Bloomberg global bond index logged its sharpest one-day drop since June, underscoring investor unease with long maturities.

This matters because soaring borrowing costs ripple into mortgages, corporate financing, and equity valuations, raising risks of broader market volatility.

🇮🇹 Italy's stocks rally but the market remains (very) cheap

Italian stocks are up about 40% this year, hitting their highest level since 2008, driven by banks and defense firms, yet they still trade at a 34% discount to global peers. That gap narrowed from a record 50% in 2023 but remains wide due to concerns over fiscal credibility and weak long-term growth. Analysts say structural imbalances and lack of reforms continue to weigh on sentiment, keeping Italian assets “too cheap.”

⏬ Why Lucid Group (LCID) Shares Are Sinking Today

Lucid Group (LCID) fell over 6% after starting trade on a 1-for-10 reverse stock split, cutting shares outstanding from 3.07B to about 307M. The move is meant to boost its per-share price, but sentiment soured after Q2 results missed estimates and 2025 production guidance was cut to 18,000–20,000 vehicles. Despite the split, fundamental challenges in demand and production remain, leaving the stock down more than 30% year-to-date.

Our Recommendations*:

💰️ Americans Born Between 1941-1979 Can Receive These 10 Benefits This Month.

👀 MarketBeat releases Top 10 Stocks for Summer 2025 report.

Invest & Strategies

📊 Some Charts That Will Surprise You

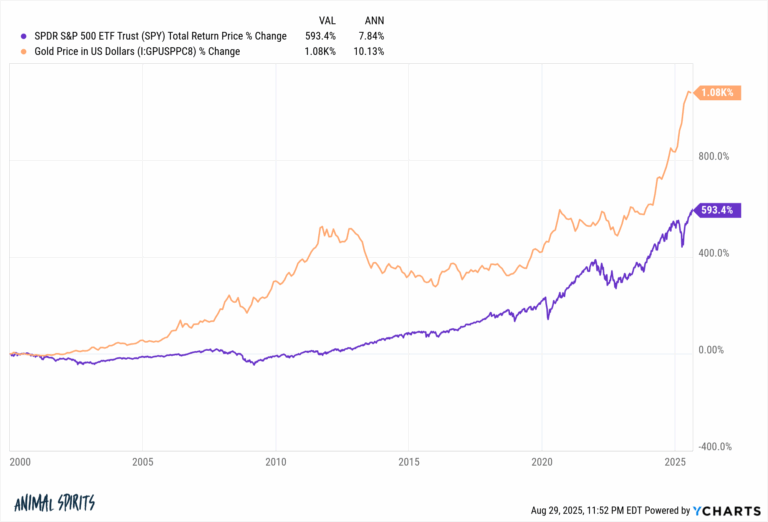

A new post from Ben Carlson highlights several surprising market charts, from the long-run performance of small-cap value vs. growth, to how gold has quietly beaten the S&P 500 since 2000, and why global stocks are now outpacing the U.S. in 2025. The takeaways challenge some common investing assumptions, well worth a click to see the full set of charts and context.

📆 History Says Sell in September. Wall Street Is Saying 'Keep Buying'

September has historically been the weakest month for stocks, with the S&P 500 averaging a 1.1% drop since 1928. This year, markets face added pressure from trade uncertainty, inflation, and a weakening labor market, alongside concerns over Trump’s push to influence the Fed. Still, strong corporate earnings, expected rate cuts, and booming AI demand give analysts confidence in long-term upside.

😭 Underperforming the S&P 500

Most investors accept diversification but rarely expect how long it can lag the S&P 500, sometimes for a decade or more. One top-performing asset allocation model trailed the index for 12 straight years through 2022, one of the worst stretches ever. With markets shifting in 2025, analysts suggest we may be entering a “Bull Market for Diversification.”

🤷 Nvidia Just Posted 56% Sales Growth, but the Market Shrugged. Should You?

Nvidia (NVDA) posted 56% revenue growth last quarter, with sales up nearly 700% in three years, yet the stock slipped after earnings as investors took profits.

CEO Jensen Huang points to the next big catalyst: robotics and “physical AI”, with billions in expected demand from factories, vehicles, and industrial automation.

The launch of Jetson Thor, already adopted by Amazon, Boston Dynamics, and Medtronic, positions Nvidia for long-term growth, even as China sales vanish amid geopolitical tensions.

👀