- Investing Journal

- Posts

- 📈 2026 Could Be a Monster Year for Stocks

📈 2026 Could Be a Monster Year for Stocks

Why Everyone’s Nervous About Their Job Right Now

Good Morning & Happy Friday.

Markets were closed for Thanksgiving, so it’s a slow news day today. But bold S&P 500 predictions are here, so stay tuned!

Grab you Flat White and let’s get into it! ☕️

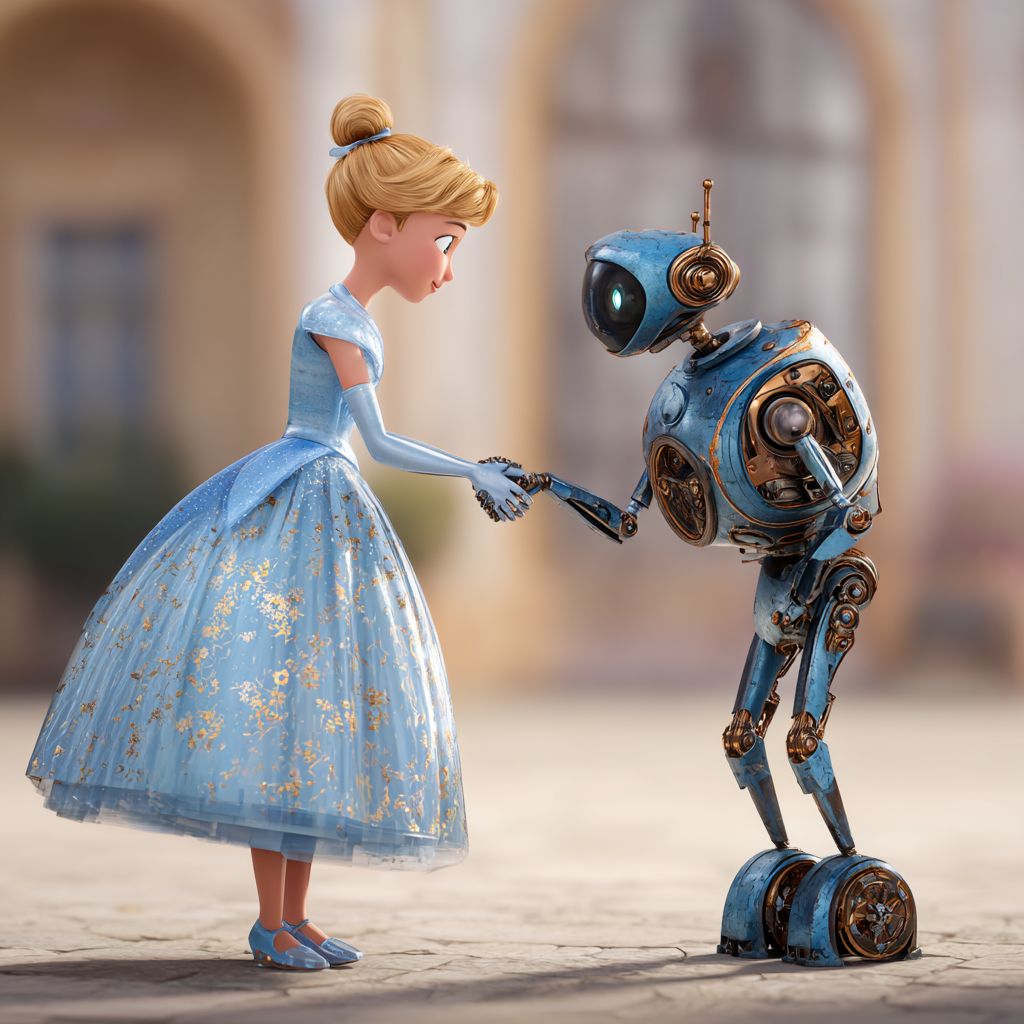

Cinderella Meets Next-Gen Tech - Limited Shares Available

What happens when the world’s most recognizable characters merge with AI? Elf Labs, holder of 500+ copyrights and trademarks, including Cinderella and Snow White, is about to show us. They’re bringing 12 tech patents to turn these iconic characters into dynamic, interactive experiences—on 200M+ screens globally. Join Elf Labs as they redefine global entertainment.

This is a paid advertisement for Elf Lab’s Regulation CF offering. Please read the offering circular at https://www.elflabs.com/

Market News

📈 Wall Street's 2026 forecasts are rolling in, and some see the S&P 500 hitting 8,000

Wall Street’s crystal ball is out, and it’s seeing big numbers. Deutsche Bank just dropped a bold call, they’re targeting S&P 500 at 8,000 by the end of 2026, thanks to earnings momentum, stock buybacks, and AI-powered tailwinds. Other major players like JPMorgan, HSBC, and Morgan Stanley are circling 7,500–7,800, but admit that a dovish Fed could send markets even higher. Key theme? AI boom + policy support = bull market 2.0.

🇨🇳 Puma shares pop 18% after report of Chinese buyer

Puma shares soared nearly 19% after reports surfaced that China’s Anta Sports may be eyeing a buyout of the struggling German brand. Puma’s been in reset mode post-Covid, battling slumping sales, high inventory, and a brutal sportswear market. Anta, Li Ning, and Asics are all reportedly circling, but no deals are on the table yet.

😢 Layoffs are piling up, raising worker anxiety

The U.S. job market is stuck in limbo, companies aren’t hiring much, but they’re still laying off. From AI investments to Trump’s new tariffs and even a 43-day federal shutdown, multiple factors are shaking worker confidence. Unemployment ticked up to 4.4%, and job data is patchy at best, the government won't even release full numbers for October.

⛏️ Deutsche Bank raises 2026 gold price forecast to $4,450/oz

Deutsche Bank just bumped its 2026 gold forecast to $4,450 an ounce, up from $4,000, pointing to strong central bank buying and steady investor demand. They now see gold trading between $3,950 and $4,950 next year.

This week in Tech

🪖 US defense firm Anduril faces setbacks from drone crashes

Anduril’s Altius drones crashed twice during U.S. Air Force tests this month, with one nosediving 8,000 feet over Florida. The incidents come as Anduril's Ghost drones also struggled in Ukraine, facing Russian electronic warfare. The company claims these are “isolated examples” and says an upgraded Ghost model is already in the works.

🛍️ AI takes over the holiday shopping wars

The 2025 holiday season is officially AI’s retail debut. Major players like Amazon, Target, Walmart, and Google are unleashing smart shopping tools to help consumers find, decide, and buy faster than ever. From AI gift guides in ChatGPT to "Help Me Decide" buttons and in-store navigation, this tech wave marks retail’s biggest leap since e-commerce began. Expect AI-driven traffic to spike over 1,000% on peak shopping days, and Visa and Mastercard are already prepping for AI-made purchases.

⌚️ Why can’t ChatGPT tell time?

Despite being a digital assistant, ChatGPT still can’t reliably tell the time. Sometimes it’s spot on, other times it’s wildly off, even within minutes of the same conversation. The issue? It doesn’t have access to your device’s clock or real-time data unless special features like web access are enabled. For now, AI may ace math and language... but clocks? Not so much.

👀 Here are the 49 US AI startups that have raised $100M or more in 2025

It’s been a record-breaking year for U.S. AI startups, with 49 companies raising $100M+ in 2025 alone. Several raised multiple mega-rounds, and at least seven cleared the $1B mark in a single raise. Names like Anysphere, Reflection AI, Cognition AI, and OpenAI led the pack, as venture capital flooded into infrastructure, healthcare, legal tech, and coding tools.

Invest & Strategies

🤔 Wait, Are We in a Recession???

On the latest Animal Spirits, Ben Carlson asks the big one: Are we already in a recession? Markets just saw their worst reversal in over three decades, while inflation continues to crush the middle class and P/E ratios refuse to budge. Throw in layoffs, Fed flubs, and even Ben selling Bitcoin, and yeah, it’s getting weird out there.

🤯 Is This How the AI Bubble Pops?

Nick Maggiulli warns that AI's investment boom may be hiding a financial landmine, conduit debt financing. Much like mortgage-backed securities pre-2008, these SPV-backed deals could spiral if compute demand dips, something investors assume can’t happen. If that assumption cracks, the fallout could hit pensions, insurers… even the Fed.

🛖 How I’d Invest $250,000 Cash In Today’s Market

With $250K to deploy, Financial Samurai is going long on private AI, real estate, and Treasuries. His split? 30% in venture capital (especially AI via Fundrise), 25% in real estate, 20% each in stocks and bonds, and a small sliver in education. The strategy balances safety and long-term upside, with a heavy bet that AI and CRE will lead the next big wave.

🔎 P/E Re-Ratings Off The High

From Oct 29 to Nov 20, the S&P 500 dropped 5.1%, but valuations dropped even harder. 8 out of 10 sectors saw P/E compression, with Tech taking the biggest hit: a sharp drop from 31.7x to 27.2x forward earnings.